Paying for a Funeral: What you need to know.

Planning a funeral is never easy, especially when it comes to the financial aspect. It’s essential to understand the various options available to ensure your loved one receives a fitting farewell without causing financial strain. This guide aims to provide a comprehensive overview of paying for a funeral, helping you navigate this challenging time with clarity and confidence.

Understanding funeral costs

Funeral costs can vary widely based on location, services selected, and personal preferences. Generally, the primary expenses include:

- Professional Services: Funeral director’s fees cover services such as planning, legal paperwork, and coordination with third parties.

- Transport: Costs for transferring the deceased to the funeral home and to the final resting place.

- Coffin or Casket: Prices range significantly based on materials and design.

- Ceremony: Venue hire, officiant fees, and any additional elements like music or flowers.

- Burial or Cremation: Fees for the plot or cremation services.

- Memorialisation: Headstones, plaques, or other forms of remembrance.

Payment Options

Pre-Paid Funeral Plans

Pre-paid funeral plans allow individuals to pay for their funeral in advance, locking in current prices and relieving the financial burden on family members. These plans can be customised to include specific services and preferences.

Advantages:

- Fixed prices, avoiding future cost increases.

- Flexibility in payment options (lump sum or instalments).

- Peace of mind knowing arrangements are handled.

Disadvantages:

- Potential for limited flexibility if circumstances change.

- Some plans may not cover all costs (e.g., third-party fees).

Funeral Insurance

Funeral insurance policies are designed to cover funeral expenses, paying out a predetermined sum upon the policyholder’s death. These policies are similar to life insurance but specifically intended for funeral costs.

Advantages:

- Guaranteed payout.

- Affordable monthly premiums.

Disadvantages:

- Total premiums paid over time may exceed the funeral cost.

- Some policies may have waiting periods before full benefits are available.

Savings and investments

Some individuals prefer to set aside savings or investments specifically for funeral expenses. This method allows for more control and flexibility but requires disciplined saving.

Advantages:

- Flexibility in use of funds.

- Potential for growth if invested wisely.

Disadvantages:

- Risk of not saving enough.

- Funds might be needed for other emergencies.

Government Assistance

In Australia, some government programs provide financial assistance for funerals, especially for those in financial hardship or without sufficient assets. Eligibility and benefits vary, so it’s crucial to check local resources.

Advantages:

- Available for those in need.

- Can cover basic expenses.

Disadvantages:

- Limited funds.

- May not cover all costs.

Accessing funds from the estate

It’s often possible to access funds from the deceased’s estate to cover funeral expenses. Most banks will release funds directly to the funeral service provider if presented with the invoice and necessary documentation, such as a death certificate and proof of identity.

Advantages:

- Utilises the deceased’s assets.

- Reduces the immediate financial burden on family members.

Disadvantages:

- May require legal documentation and proof.

- Processing time can vary depending on the bank and the estate’s complexity.

Managing Funeral Costs

To manage funeral costs effectively:

- Request a Detailed Quote: Although Tobin Brothers Funerals provides a written estimate at the arrangement meeting, you can see all of our fees in detail on our Funeral Funeral Costs | Melbourne Funeral Directors page.

- Discuss with Family: Ensure everyone involved understands and agrees on the financial plan.

- Step away from Emotion: Do not over-extend your budget based purely on emotion or pressure from others.

- Consider Simple Options: Having a single location or a simpler service can be more affordable without compromising dignity.

- Speak to your Funeral Planner: Our expert team can help you arrange a funeral within your means without limiting the meaning of your service.

Want to know more about Funeral Costs?

Paying for a funeral requires careful planning and consideration. By understanding the various payment options and managing costs effectively, you can ensure your loved one receives a respectful and dignified farewell without undue financial stress.

Whether you opt for a pre-paid plan, funeral insurance, personal savings, government assistance, or accessing funds from the estate, the key is to make informed decisions that align with your financial situation and personal preferences.

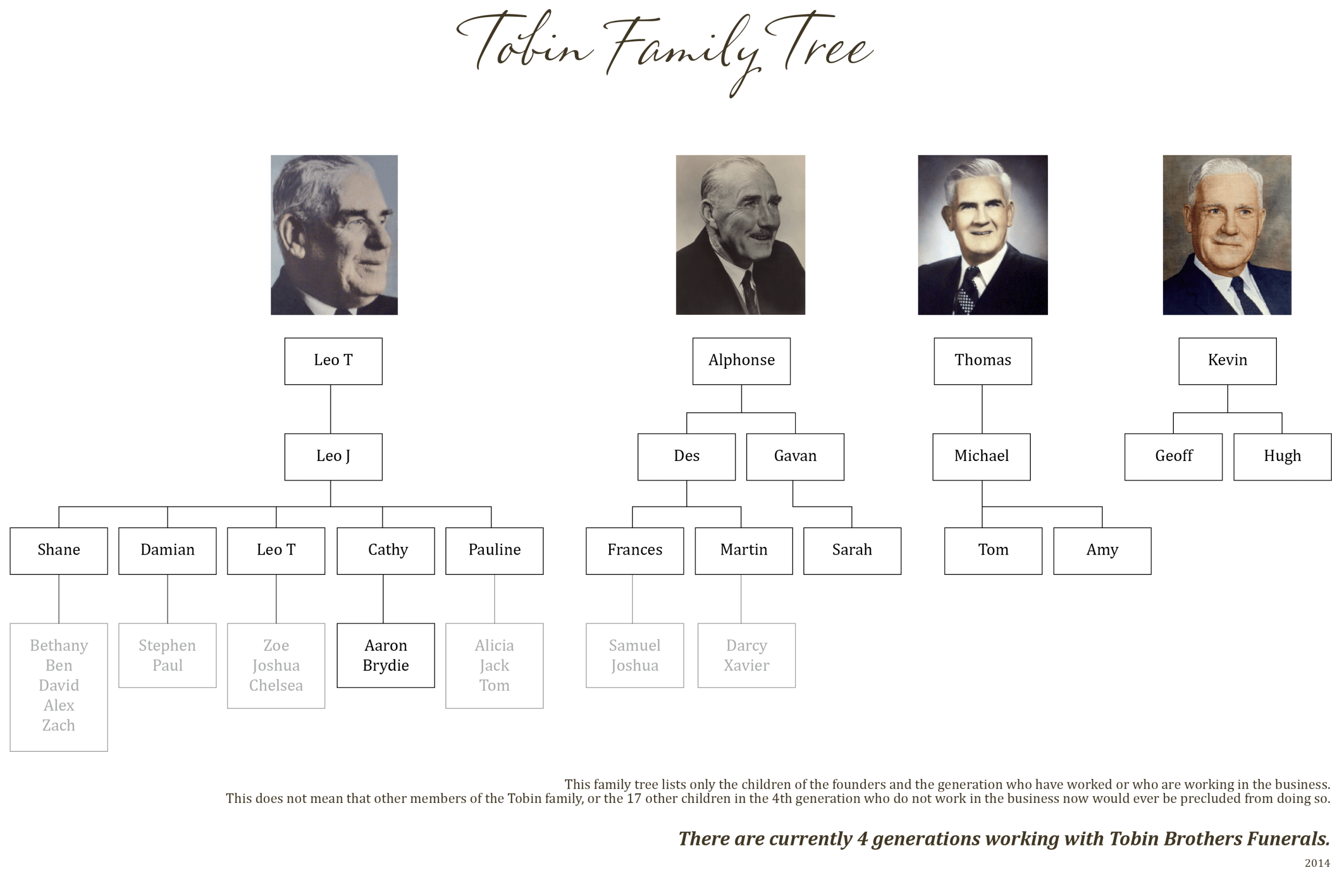

At Tobin Brothers, we are committed to providing the highest level of care for all families.

Speak to our friendly Funeral Advice Line today for more details or to get an obligation free estimate.

Nick Fogarty

General Manager, Tobin Brothers Funerals